Edgile Speaks at Global Banking Event FS-ISAC

“Among financial services IT professionals, timely knowledge about one’s enterprise is critical in identifying potential cyber risk gaps and vulnerabilities to sensitive business information. Finding and remediating security and compliance gaps ensures programs, practices, and investments are safeguarded from intrusion—which is essential for enterprise-wide stability and maintaining consumer brand trust.”

–David Deckter, Edgile partner

This week — at the 2017 FS-ISAC Fall Summit in Baltimore — Edgile partner David Deckter will unveil an award-winning approach that financial services firms can adopt to protect against risk in the new digital economy.

The event is both relevant and timely, for several reasons. Practically every enterprise today needs to rethink their cyber-risk strategy. But financial services firms are facing exceptional challenges. In his talk at FS-ISAC, David will unpack unique perspectives on the following:

- New regulatory and compliance mandates are putting increasing pressure on firms to have more robust risk assessments on their IT environment. Among those mandates: the New York State Department of Financial Services (NYDFS) cybersecurity requirements for financial services companies. New York — the world’s leading financial capital — tends to set the regulatory and compliance trends, and financial services firms need to keep up with best practices.

- Diagnostics — with carefully cultivated questions and traceability to mandates — can improve the quality and consistency of the risk assessments while simultaneously reducing the costs and complexities. More than ever, financial services firms need to look at diagnostic tools that can help them understand the present and foresee the future. These tools can help firms not only understand improve their vision today but predict problems become they become manifest. They can also help enterprises contain the costs that inevitably accrue.

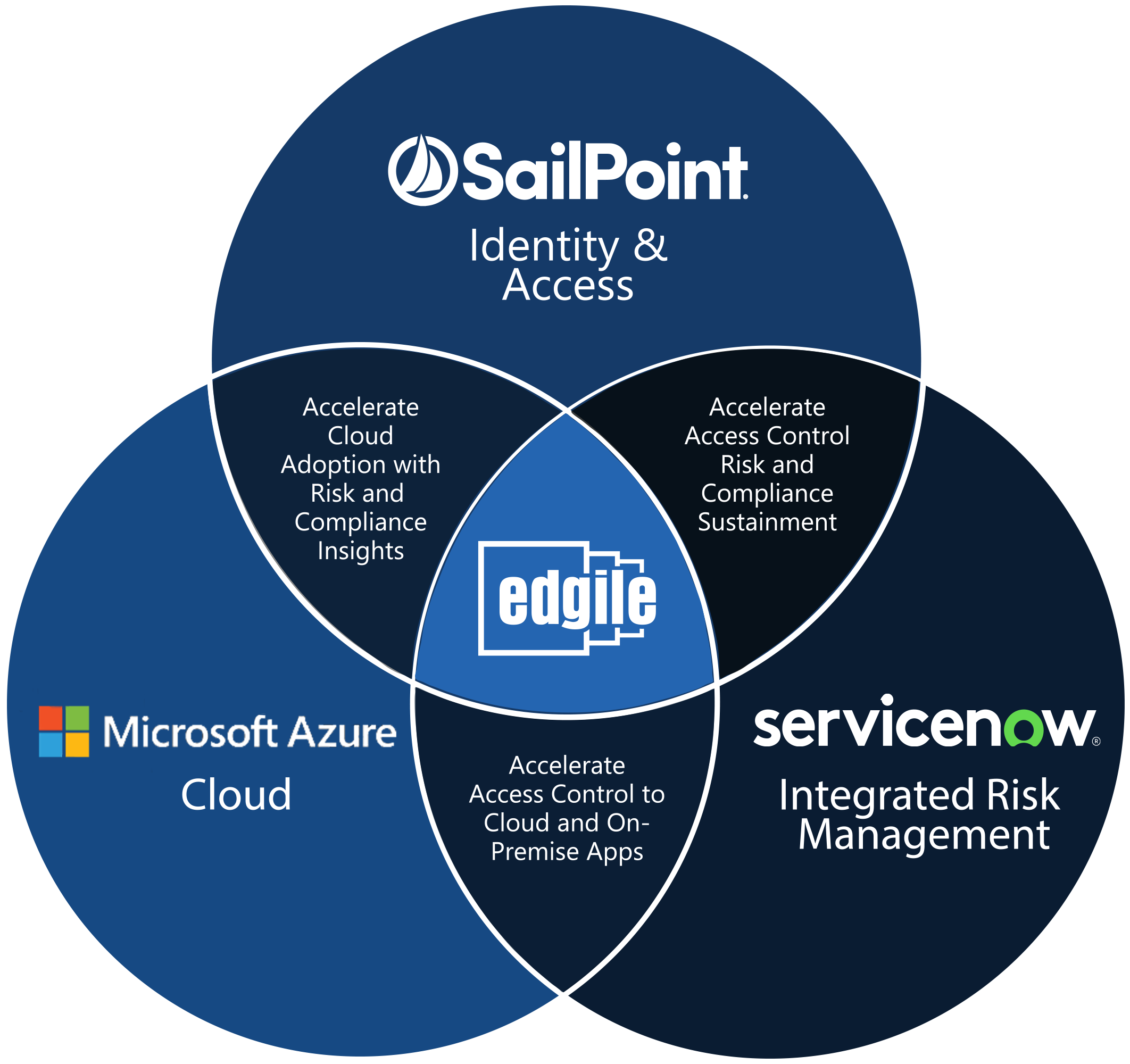

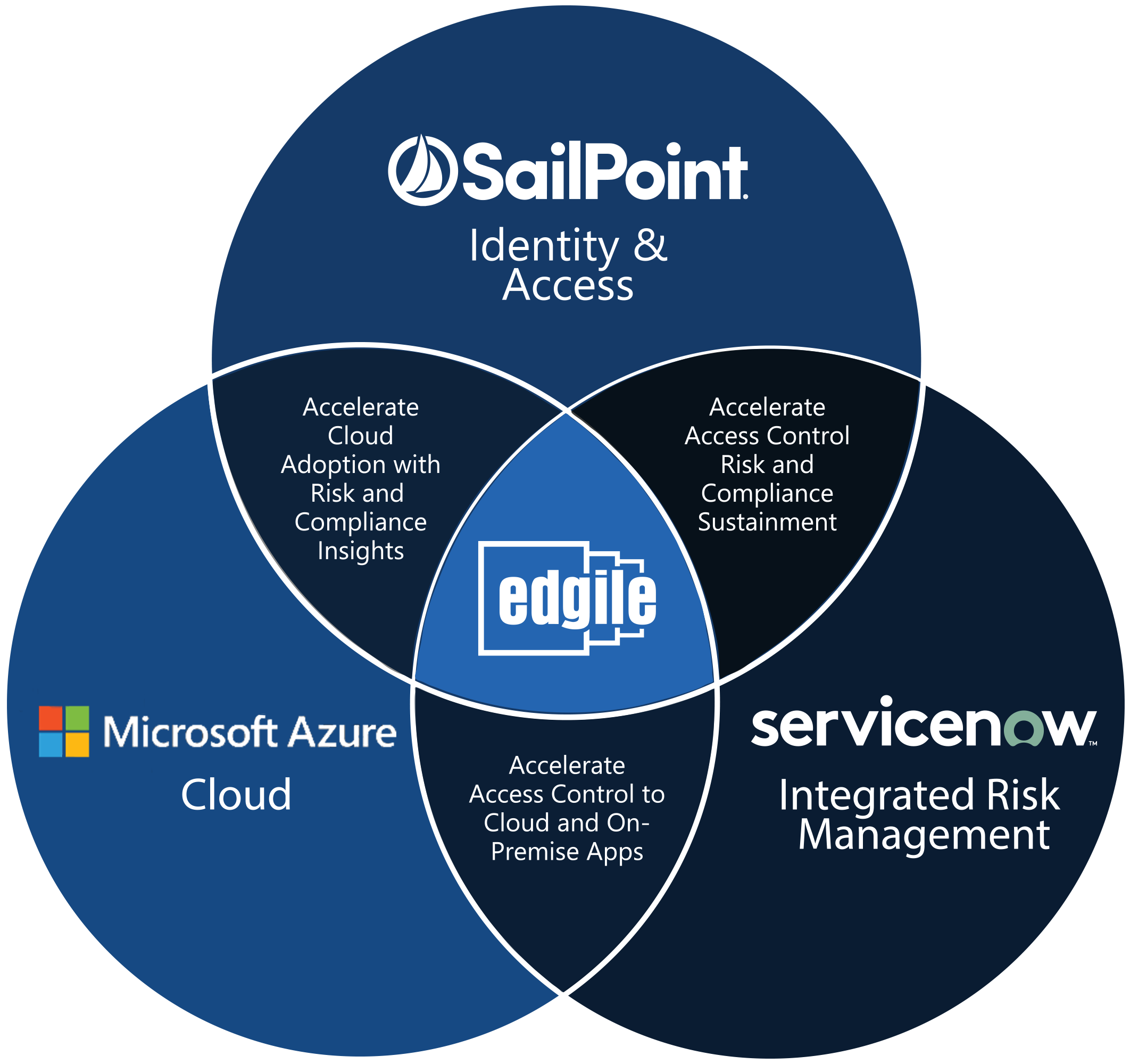

- Benchmarking — along with integrated risk and compliance views — can be achieved when the solution is designed and delivered using Edgile’s “Service Enablement Model.” Serving some of the world’s biggest and most regulated firms, Edgile has been developing a number of ways to protect the modern enterprise against cyber risk in the evolving digital age.

One way: provide benchmarks, which help clients understand how they are faring in comparison to industry peers.

Another way: developing models that help businesses get a holistic, integrated view of their risk powered by both technology and the world’s largest library of regulatory and compliance data. Deckter will talk about how these capabilities can support leaders in the financial services sector, while foreshadowing what the future will bring with new technologies and service models.