Learn how insurance companies are accelerating Cloud initiatives while simultaneously improving risk and security capabilities and reducing costs.

Insurance firms are facing a series of regulatory compliance onslaughts from both state commissioners and privacy laws which are slowing down their ability to serve policy holders and the business with new cloud-based workloads as risk and security concerns are taking a long time to address.

While the various stakeholders involved in getting the cloud initiatives into production want to do the right thing, clearly and consistently defining what those tasks are have been challenging for the insurers.

The audience will benefit from learning how:

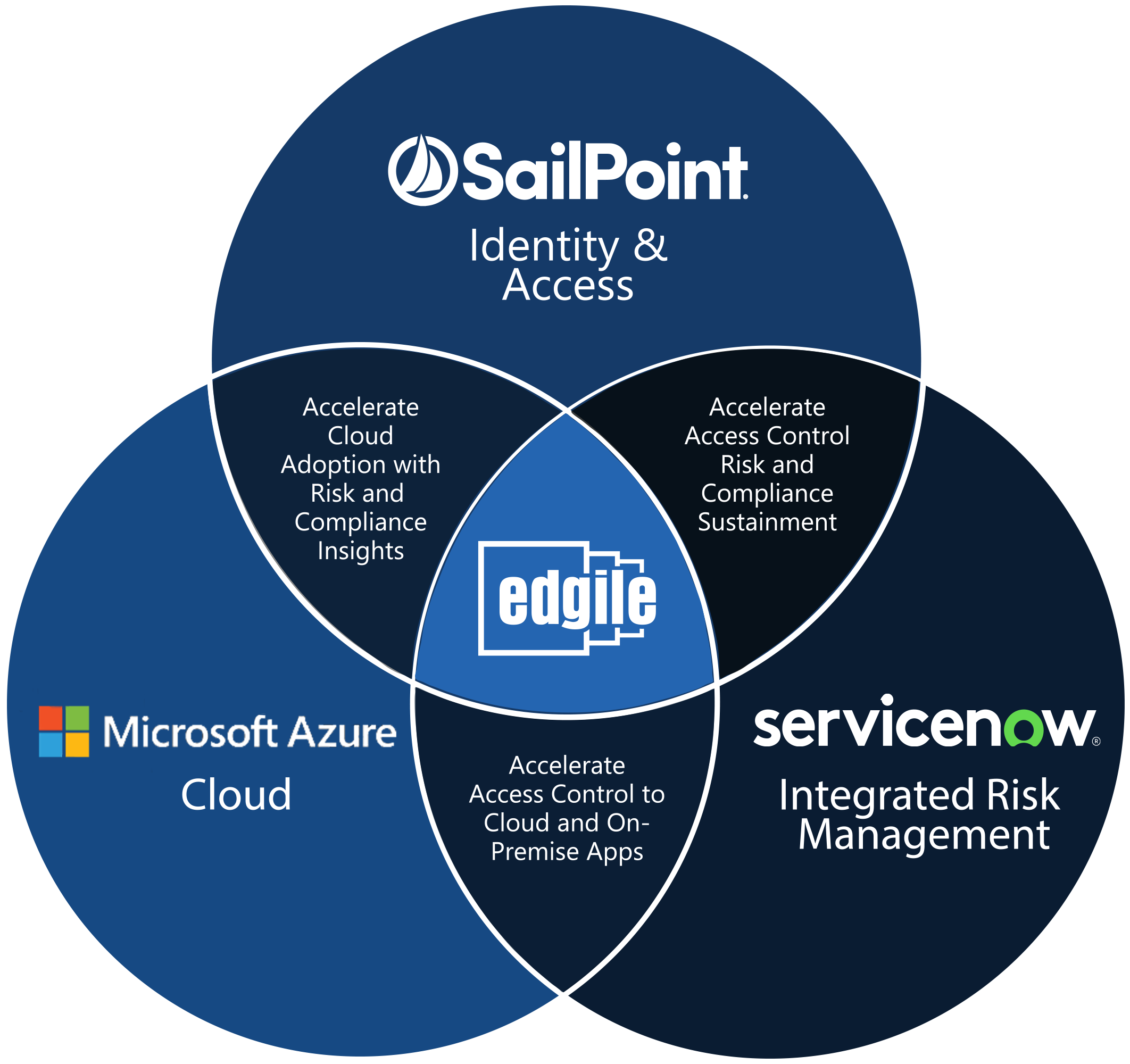

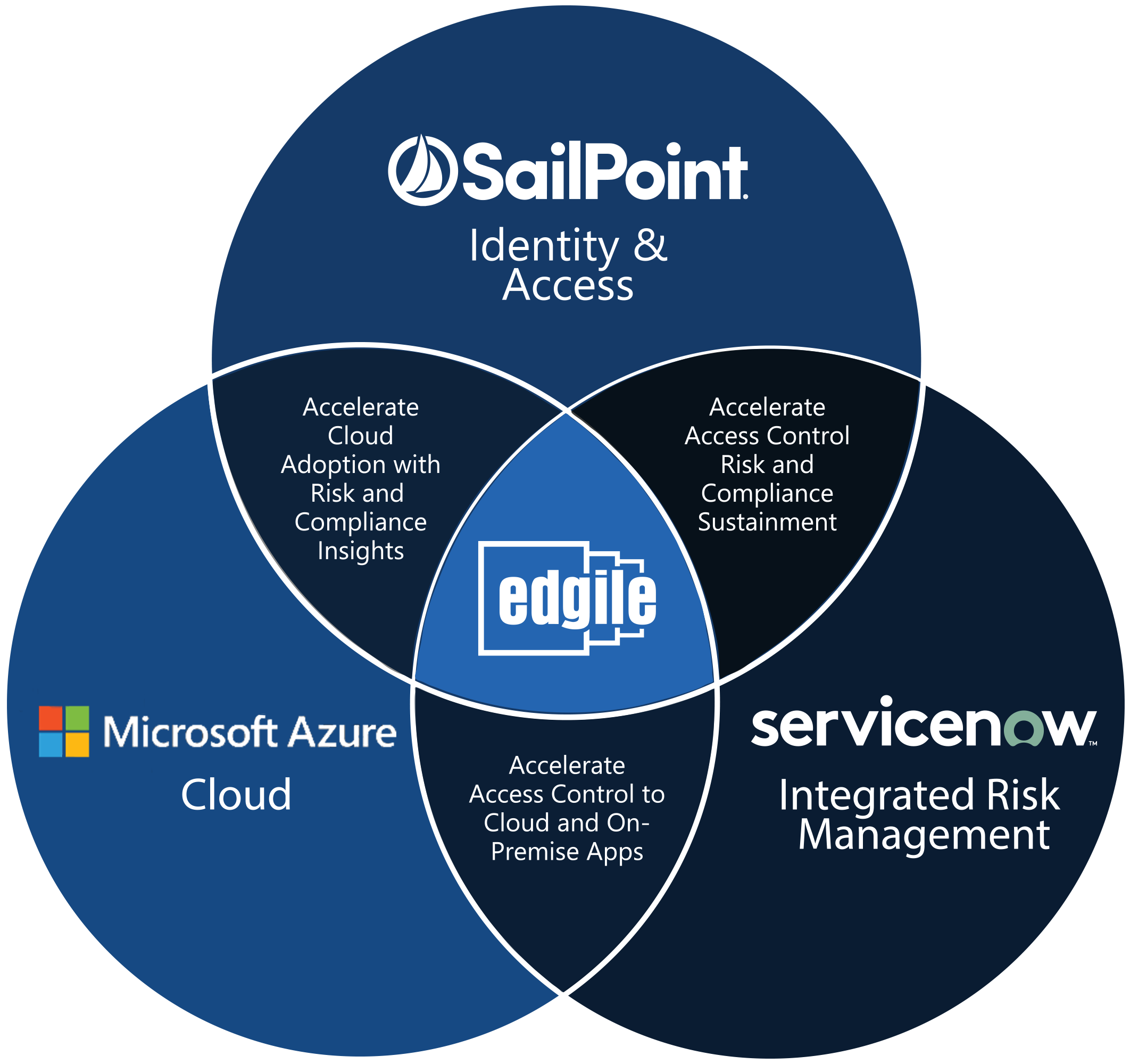

- Multiple insurance firms’ stakeholder requirements can be met through a unified Decision Engine

- ServiceNow can provide consistent confidentiality, integrity, availability, regulatory, privacy, ethics and compliance, and vendor risk ratings – along with the corresponding consultation and fulfillment tasks needed before the cloud-based workloads can go into production

- Clients are also sustaining risk and security throughout the Plan-Build-Run lifecycle through continuous monitoring, along with smart integration points to further empower the builders to “build it right the first time”

Speakers:

Brian Rizman, Partner, Edgile

David Deckter, Partner, Edgile

Jay Dial, Senior Manager, Edgile

Ryan Bennink, Risk and Compliance Specialist, ServiceNow

Will Brannan, Security Solution Architect, ServiceNow